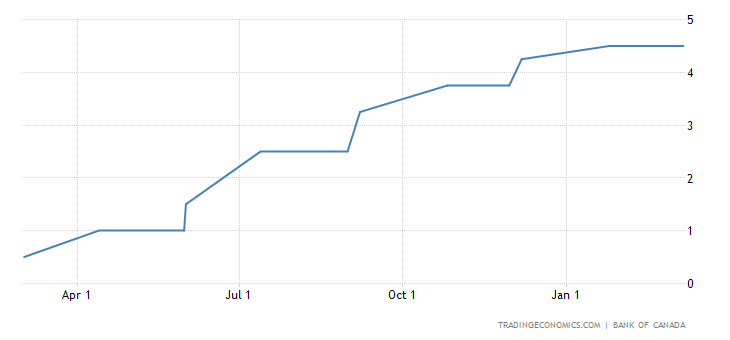

March 8, 2023: Bank of Canada Keeps Policy Rate Unchanged and Maintains Quantitative Tightening Stance

Bank of Canada Holds Overnight Rate and Continues Quantitative Tightening Policy

Sources: Bank of Canada, Trading Economics

In its recent announcement, the Bank of Canada maintained its target for the overnight rate at 4½%, with the Bank Rate at 4¾% and the deposit rate at 4½%. The Bank also affirmed its policy of quantitative tightening.

Global economic developments have been consistent with the outlook outlined in the January Monetary Policy Report (MPR). Although global growth continues to slow, inflation is decreasing due mainly to lower energy prices. In the United States and Europe, growth and inflation expectations are higher than anticipated in January, with labour markets remaining tight and elevated core inflation persisting. Meanwhile, China’s growth is rebounding in the first quarter, but Russia’s war in Ukraine and the strength of China’s recovery are both key sources of upside risk.

In Canada, economic growth was flat in the fourth quarter of 2022, lower than projected by the Bank. Restrictive monetary policy continues to weigh on household spending, and business investment has weakened alongside slowing domestic and foreign demand. However, the labour market remains tight, with employment growth surprising on the upside, the unemployment rate near historic lows, and job vacancies elevated.

Inflation declined to 5.9% in January, primarily due to lower price increases for energy, durable goods and some services. Food and shelter prices remain high, causing continued hardship for Canadians. With weak economic growth for the next few quarters, pressure in product and labour markets are expected to ease, moderating wage growth and increasing competitive pressures.

The Bank expects CPI inflation to decline to around 3% in the middle of this year. Governing Council will continue to evaluate economic developments and the impact of past interest rate increases, and is willing to increase the policy rate further if necessary to return inflation to the 2% target. The Bank remains committed to restoring price stability for Canadians.

The Bank will announce the next overnight rate target on April 12, 2023, along with the next full outlook for the economy and inflation, including risks to the projection in the Monetary Policy Report.

To read more local news and updates please check our BLOG PAGE

To view Geoff Jarman’s Listings CLICK HERE