City of Burnaby: the introduction of amenity cost charges responds to recent provincial legislation aimed at reforming development financing.

Source: Storeys, City of Burnaby

In November, the Province of British Columbia unveiled plans for a new development financing tool to streamline housing construction timelines. This tool, presented through Bill 46, the Housing Statutes (Development Financing) Amendment Act, includes the implementation of amenity cost charges (ACCs) and modifications to the existing development cost charges (DCCs) and community amenity contributions (CACs) framework.

Currently, municipal governments impose DCCs (referred to as development cost levies or DCLs in Vancouver) on all new development projects. These charges, typically paid early in the approval process, are earmarked for specific infrastructure needs like roads and sewers.

CACs, meanwhile, are levied on rezoning projects. Although cities often have established rates, the actual amounts are subject to negotiations between the city and developers. This negotiation process, which can include determining whether contributions will be provided as physical amenities or cash, may delay housing delivery. Like DCCs, CACs are restricted to funding purposes such as parks, childcare facilities, and community centers.

With the implementation of these new measures, the Province is broadening the scope of what DCCs can fund while reducing the influence of CACs. Additionally, it is introducing more streamlined ACCs to enable local governments to continue covering growth-related expenses.

Under the updated regulations, DCCs and DCLs can now also finance fire-protection, police, and solid-waste facilities, as well as provincial highway infrastructure projects. Conversely, the emphasis on CACs is indirectly lessened through recent provincial legislation that pre-zones large areas of land, resulting in fewer rezoning projects and consequently fewer opportunities for local governments to levy CACs.

The newly established ACCs will contribute to community amenities such as community and recreation centers, childcare facilities, and other public spaces. While similar in purpose to CACs, ACCs will be charged at fixed rates—eliminating negotiation processes—and collected upfront in the development phase, akin to DCCs.

Furthermore, although CACs can currently be imposed on affordable housing projects, cities have the discretion to waive these charges. However, the Province is now taking this decision out of municipal hands and forbidding ACCs on affordable housing projects, although a precise definition of “affordable” has yet to be provided.

While the changes to DCCs will apply province-wide, the adoption of ACCs by local governments remains optional. Nonetheless, given the reduced impact of CACs, many are likely to opt for ACCs.

City of Burnaby

The City of Burnaby has emerged as one of the early adopters of ACCs, deliberating over a series of proposed rates during a recent special council session.

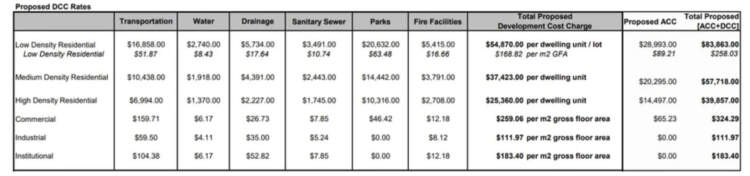

Under the proposal, the City suggests ACC rates of $28,993 per residential lot for low-density residential developments, $20,295 per residential unit for medium-density residential developments, and $14,497 per residential unit for high-density residential developments. Additionally, a rate of $65.23 per square meter of gross floor area is proposed for commercial developments.

Initially, the proposed rates for low-density residential developments were presented on a floor area basis, as previously requested by the Council. However, the City has decided to proceed with rates on a per unit/lot basis.

The new DCC rates and ACC rates. (City of Burnaby)

In a report presented to the Council, City staff projected an annual population growth of 1% to 2% over the next 25 years, equating to approximately 100,000 new residents. The current population is estimated to be around 250,000.

In response to this growth and recent provincial legislation promoting new housing initiatives, the City is transitioning towards a DCC and ACC model to address growth-related expenses. This shift aims to allocate funds towards larger facilities, improved park spaces, enhanced water and sewer infrastructure, as well as policing, fire services, and transportation needs. This move is a departure from the previous reliance on a voluntary and cyclical Community Benefit Bonus (CBB) program.

In City of Burnaby, CACs are known as Community Benefit Bonuses (CBBs). City staff elucidates the transition away from CBBs towards ACCs, mentioning that while CBB charges will remain an option, the availability and usage of these funds remain uncertain. This outcome aligns with the City’s objectives.

On Monday, February 26th, Burnaby City Council approved its new Development Permit Transition process. This introduces a stage between the rezoning application and building permit stage, addressing a gap previously unique to Burnaby among major BC municipalities. This stage is commonly used to regulate the form and character of development, contrasting with Burnaby’s former reliance solely on the rezoning process. This shift aligns with the provincial trend towards pre-zoning.

City staff acknowledge that the new DCC and ACC-centric program does not solve all infrastructure funding challenges. They stress the importance of considering other funding tools, including taxation.

Finalized rates are expected to be presented for approval on March 25th, allowing Council to grant first, second, and third readings. The amended DCC bylaw will then require approval from the Provincial Inspector of Municipalities before returning to Council for final approval.

The City of Burnaby aims to implement the new DCC and ACC rates before June 30, 2024. These rates will undergo refinement and adjustment over the next two years, coinciding with the approval of the City’s new Official Community Plan and Zoning Bylaw.

To read more local news and projects please check our BLOG PAGE

To view Geoff Jarman’s Listings CLICK HERE

City of Burnaby development, City of Burnaby, City of Burnaby new development financial tool