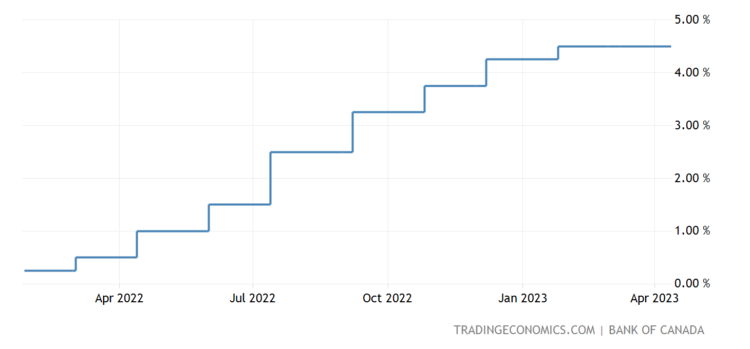

April 12, 2023: Bank of Canada Keeps Policy Rate Unchanged and Continues Quantitative Tightening Measures

The Bank of Canada has announced its decision to hold the target for the overnight rate at 4.5%, while keeping the Bank Rate and deposit rate at 4.75% and 4.5%, respectively.

Sources: Bank of Canada, Trading Economics

The Bank will also continue its policy of quantitative tightening.

While inflation in many countries is declining due to lower energy prices, tighter monetary policy, and normalized global supply chains, measures of core inflation in advanced economies suggest persistent price pressures, especially for services. Global economic growth has been stronger than anticipated, with growth in the United States and Europe surprising on the upside. However, the Bank expects the growth to weaken due to tighter monetary policy.

In Canada, the demand still exceeds supply, and the labor market remains tight. Economic growth in the first quarter looks to be stronger than expected, with a bounce in exports and solid consumption growth. However, the Bank expects consumption to moderate as more households renew their mortgages at higher rates, and restrictive monetary policy works its way through the economy. Overall, GDP growth is projected to be weak through the remainder of this year before strengthening gradually next year.

CPI inflation eased to 5.2% in February, and the Bank expects CPI inflation to fall quickly to around 3% in the middle of this year and then decline more gradually to the 2% target by the end of 2024. However, Governing Council remains prepared to raise the policy rate further if needed to return inflation to the 2% target.

Governing Council’s focus is on the evolution of core inflation, inflation expectations, and corporate pricing behavior to gauge the progress of CPI inflation back to target. In light of its outlook for growth and inflation, Governing Council has decided to maintain the policy rate at 4.5% and continue with quantitative tightening.

For more information on the Bank of Canada’s outlook for the economy and inflation, including risks to the projection, refer to the Monetary Policy Report (MPR) scheduled to be published on July 12, 2023.

To read more local news and updates please check our BLOG PAGE

To view Geoff Jarman’s Listings CLICK HERE