Data Reveals Investors Contribute to 30% of Home Purchases in Canada

The convergence of pandemic-induced low-interest rates and real estate investment marketing has spurred both Canadians and investors to acquire multiple properties.

Source: The Globe and Mail, Toronto Star

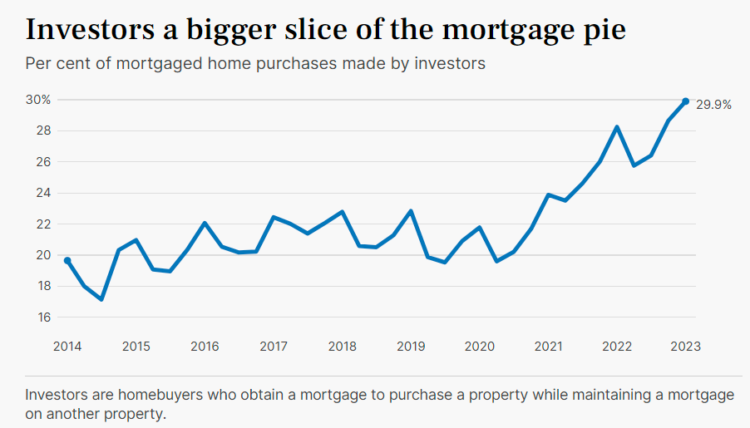

In the first part of this year, new data reveals that investors have become more prominent in Canada’s housing market, comprising 30 percent of all residential real estate purchases. During the COVID-19 pandemic, investor activity surged as escalating home prices piqued interest in residential properties as an asset class.

The Bank of Canada‘s data shows that investors were responsible for 30 percent of home purchases in the first quarter of this year, up from 28 percent in the same period last year and 22 percent in 2020. The central bank defines an investor as a buyer who took out a mortgage to buy a property while maintaining a mortgage on another home.

Conversely, the percentage of first-time homebuyers decreased from 48 percent in the same three months in 2020 to 43 percent in the first quarter of this year. Similarly, repeat buyers dropped from 30 percent to 27.5 percent over the same period.

The Bank of Canada’s data highlights the growing influence of investors in the Canadian housing market. The combination of the pandemic’s low-interest-rate environment and widespread marketing promoting real estate investing has encouraged both everyday Canadians and investors to acquire multiple properties.

The Bank of Canada noted,

‘The presence of investors in real estate markets can amplify house price cycles. During housing booms, greater demand from investors can add to bidding pressures and intensify price increases. Similarly, when prices are stable or declining, a lower influx of investors can add downward pressure on housing demand and prices.’

As of now, the federal government has not addressed individual domestic real estate investors while formulating policies to address the lack of affordable housing. Instead, Ottawa has focused on foreign real estate buyers, implementing a ban on their purchases until the end of 2024.

The central bank’s data aims to shed light on two vulnerabilities facing the Canadian economy: elevated household indebtedness and high house prices. The data reveals that some vulnerabilities are increasing, including slight upticks in delinquencies for car loans and installment loans, while mortgage delinquencies remain steady at 0.12 percent.

There has been a minor increase in highly indebted borrowers, defined as those with a mortgage 4.5 times greater than their annual income. Additionally, in the second quarter, 29 percent of new mortgage borrowers spent more than 25 percent of their gross income on mortgage payments, a level similar to previous quarters but higher than the second quarter of 2022, which stood at 19 percent. Households that allocate at least a quarter of their gross income to mortgage payments are considered more vulnerable to rising interest rates or income loss.

Meanwhile, other vulnerabilities are decreasing. The proportion of homeowners who put down less than 20 percent of a property’s purchase price has declined over the past few years. In the second quarter of this year, they accounted for 12 percent of purchases, compared to 18 percent in the same period in 2020.

The data also indicates an increase in home flipping, where buyers sell their properties within 12 months of purchase, over the past two years. However, overall, home flipping still accounted for less than 3 percent of transactions in the first quarter. The bank plans to update these indicators quarterly.

To read more local news and updates please check our BLOG PAGE

To view Geoff Jarman’s Listings CLICK HERE