BC Budget 2024 to Introduce Flipping Tax and Property Transfer Tax Enhancements

The government of British Columbia has unveiled a plan to impose a tax on the profits from properties sold within two years of acquisition.

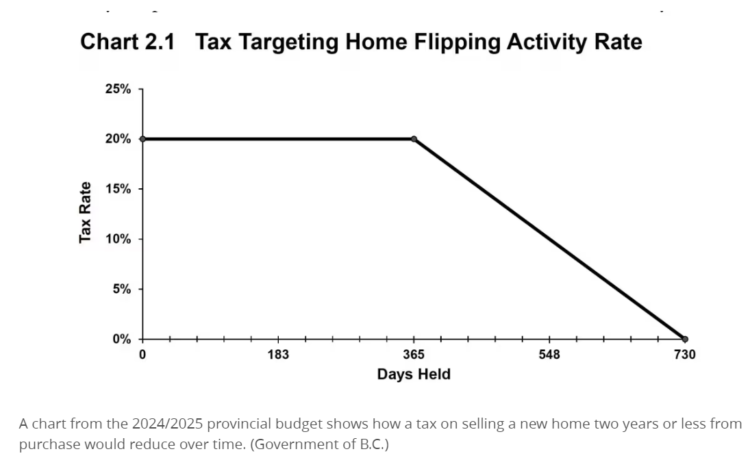

This tax is designed to reach up to 20% for properties sold within a year of purchase, and will gradually decrease to zero for properties sold between 366 and 730 days after purchase.

This tax initiative, announced by B.C. Finance Minister Katrine Conroy, is one of the latest measures introduced by the province to curb housing speculation in an area where affordable housing is a significant issue.

“As governments retreated, speculators stepped in, causing prices to rise. That’s why we’re implementing a home-flipping tax as our latest action to clamp down on these harmful practices,”

Conroy stated during her budget presentation in the legislature.

This tax is one of 20 legislative pieces the government plans to introduce this session, which means it will need to be passed within the next three months to become law. The intention is to apply this tax to properties sold on or after January 1, 2025, including those purchased before this date.

The 2024-25 budget, presented by Conroy, predicts that this tax will generate an additional $44 million in revenue for the 2025-26 fiscal year. This revenue is earmarked for the construction of affordable housing across the province. Sellers can expect to be taxed around 10% after owning a home for a year and a half, with the tax being lifted after two years of ownership.

The tax will be applicable to income from the sale of properties with a housing unit and properties zoned for residential use, as well as income from condo assignments. However, it will not apply to land or parts of land used for non-residential purposes, as per the government’s budget documents.

There are several exemptions to this tax, including life circumstances such as separation, divorce, death, disability or illness, relocation for work, involuntary job loss, change in household membership, personal safety or insolvency. “The aim of this tax is to support, not hinder, housing supply. Exemptions will be granted to those who contribute to the housing supply or participate in construction and real estate development,” the government’s budget documents state.

This tax will be payable in addition to any federal or other provincial income taxes incurred from the sale of property. Alex Hemingway, a senior economist with the Canadian Centre for Policy Alternatives, expressed uncertainty about the effectiveness of the tax in addressing speculation. He suggested that while the tax might deflate some speculative activity, it doesn’t address the root of the housing crisis, which is a shortage of overall housing and particularly non-market housing.

Hemingway also warned that the tax could unintentionally reduce home sales and transactions, diverting tax revenue away from property transfers.

In addition to the new tax, the budget introduced expanded property transfer tax exemptions, raising the First Time Homebuyers Program threshold to $500,000 for the purchase of a home valued up to $835,000.

Effective April 1, the B.C. government will increase the purchase price for first-time home buyers and buyers purchasing newly built homes to qualify for the Property Transfer Tax exemption. Until then, first-time home buyers who purchase a home with a fair market value of $500,000 or less (assuming they meet all the program qualifications) were exempt from paying the Property Transfer Tax. The tax on a home priced at $500,000 would normally be $8,000, so this is a significant benefit. After April 1, the exemption will be granted for first-time home buyers purchasing homes up to a fair market value of $835,000, with a partial exemption up to $860,000.

For a home purchased at a price of $800,000, the savings would amount to $14,000. This is particularly noteworthy because this is a closing cost that cannot be rolled into the mortgage and must be paid upfront. In this example, the minimum down payment on an $800,000 home would be $55,000.

One of the most significant hurdles people encounter is accumulating their down payment, so this increase in the exemption will provide substantial assistance to many buyers.

Please check the first-time home buyers’ exemption amounts

There have also been changes to other exemptions from the Property Transfer Tax (PPT).

Individuals purchasing newly constructed homes, whether they are first-time home buyers (FTHB) or not, can also be exempt from paying the tax.

Currently, the purchase price for this exemption is $750,000. However, effective April 1, this exemption will rise to $1.1 million, with a partial exemption up to $1.15 million.

The Secondary Suite Incentive Program is another initiative set to be introduced on April 1. In essence, the provincial government will offer a forgivable loan covering up to 50% of the cost of renovations to add a secondary suite to an existing home, up to a maximum of $40,000. Applications for this program will start being accepted from April 17.

To have the loan fully forgiven, certain conditions must be fulfilled:

• The unit must be constructed in the same location where the homeowner resides.

• The unit must be rented out at rates below the market value for five years.

Furthermore, the province will also exempt eligible purpose-built rental buildings that have four or more units from the property transfer tax until 2030.

Sources: CBC News, Castanet, Government of British Columbia

To read more local news and projects please check our BLOG PAGE

To view Geoff Jarman’s Listings CLICK HERE