JUNE 2023 METRO VANCOUVER HOUSING MARKET HIGHLIGHTS

Home Prices Continue to Rise in Housing Market to Kick Off Summer

Source: REBGV

Continuing the trend that has emerged in the housing market this year, the benchmark price for all home types in Metro Vancouver1 increased in June as home buyer demand butted up against a limited inventory of homes for sale in the region.

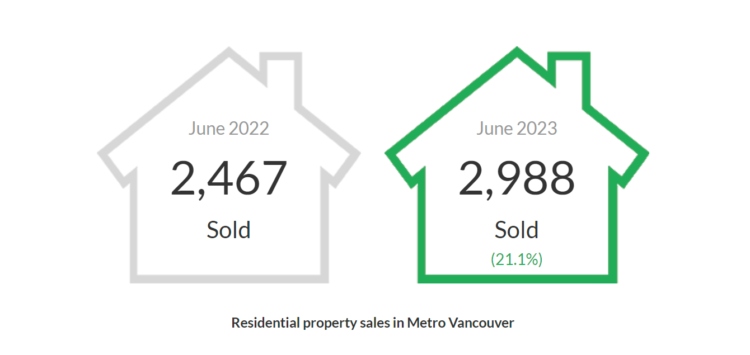

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales2 in the region totalled 2,988 in June 2023, a 21.1 per cent increase from the 2,467 sales recorded in June 2022. This was 8.6 per cent below the 10-year seasonal average (3,269).

“The market continues to outperform expectations across all segments, but the apartment segment showed the most relative strength in June. The benchmark price of apartment homes is almost cresting the peak reached in 2022, while sales of apartments are now above the region’s ten-year seasonal average. This uniquely positions the apartment segment relative to the attached and detached segments where sales remained below the ten-year seasonal averages.”

Andrew Lis, REBGV director of economics and data analytics

There were 5,348 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in June 2023. This represents a 1.3 per cent increase compared to the 5,278 homes listed in June 2022. This was 3.1 per cent below the 10-year seasonal average (5,518).

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 9,990, a 7.9 per cent decrease compared to June 2022 (10,842). This was 17.4 per cent below the 10-year seasonal average (12,091).

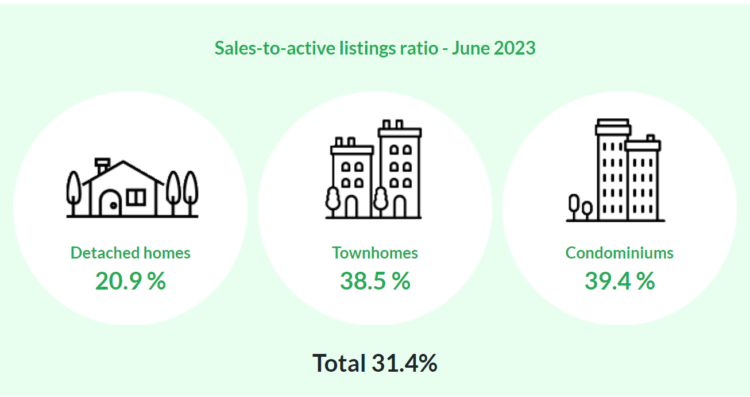

Across all detached, attached and apartment property types, the sales-to-active listings ratio for June 2023 is 31.4 per cent. By property type, the ratio is 20.9 per cent for detached homes, 38.5 per cent for townhomes, and 39.4 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“Despite elevated borrowing costs, there continues to be too little resale inventory available relative to the pool of buyers in Metro Vancouver. This is the fundamental reason we continue to see prices increase month over month across all segments,” Lis said. “With the benchmark price for apartments now standing at $767,000, we repeat our call to the provincial government to adjust the $525,000 threshold exempting first-time home buyers from the Property Transfer Tax, to better reflect the price of entry-level homes in our region. This is a simple policy adjustment that could help more first-time buyers afford a home right now.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,203,000. This represents a 2.4 per cent decrease over June 2022 and a 1.3 per cent increase compared to May 2023.

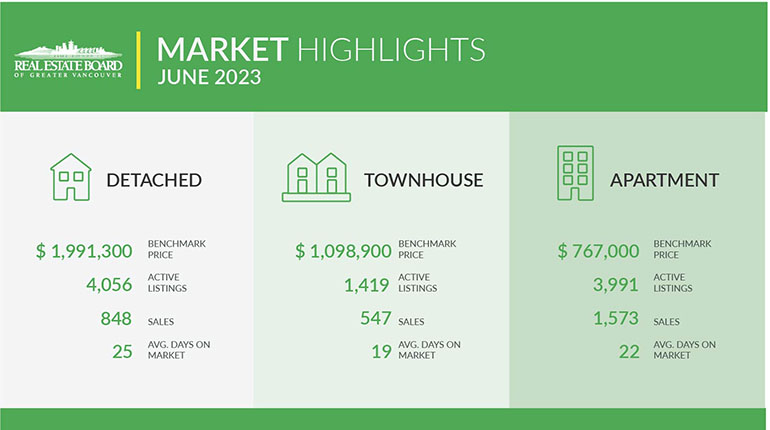

Sales of detached homes in June 2023 reached 848, a 28.3 per cent increase from the 661 detached sales recorded in June 2022. The benchmark price for a detached home is $1,991,300. This represents a 3.2 per cent decrease from June 2022 and a 1.9 per cent increase compared to May 2023.

Sales of apartment homes reached 1,573 in June 2023, an 18.6 per cent increase compared to the 1,326 sales in June 2022. The benchmark price of an apartment home is $767,000. This represents a 0.5 per cent increase from June 2022 and a 0.8 per cent increase compared to May 2023.

Attached home sales in June 2023 totalled 547, a 17.6 per cent increase compared to the 465 sales in June 2022. The benchmark price of an attached home is $1,098,900. This represents a one per cent decrease from June 2022 and a 1.5 per cent increase compared to May 2023.

1 Editor’s Note: Areas covered by the Real Estate Board of Greater Vancouver include: Bowen Island, Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, Sunshine Coast, Vancouver, West Vancouver, and Whistler.

2 REBGV is now including multifamily and land sales and listings in this monthly report. Previously, we only included detached, attached, and apartment sales, and these additional categories, which typically account for roughly one to two per cent of total MLS® activity per month, are being included for completeness in our reporting.

CLICK HERE – Full REBGV June 2023 Market Update

Vancouver BC – July 5, 2023

Have a look at the REBGV June 2023 Market Update Insights!

- DOWNLOAD the REBGV June 2023 Market Update CLICK HERE

- See the Monthly Market Stats CLICK HERE

- For more market information from the Real Estate Board of Greater Vancouver CLICK HERE

- To view Geoff Jarman’s Listings CLICK HERE

Tags: real estate Vancouver, Vancouver real estate, Vancouver realestate, home sales, Vancouver homes sale, house prices, housing prices, house buying, real estate vancouver market, Vancouver market, real estate agent Vancouver, Burnaby realtor, Geoff Jarman, Geoff Jarman top Burnaby realtor, 2023 market news, Vancouver Multifamily Market, June 2023 market news, housing market